Hawaii paycheck tax calculator

Kentucky is one of the states that underwent a tax revolution in 2018 making its tax rates much easier to follow and learnSince 2018 the state has charged taxpayers with a flat income tax. The results are broken up into three sections.

Employer Taxes 101 Fica Futa Suta Decoded Proservice Hawaii

Your average tax rate is.

. That means that your net pay will be 41883 per year or 3490 per month. The Hawaii income tax has twelve tax brackets with a maximum marginal income tax of 1100 as of 2022. Your average tax rate is 239 and your marginal tax rate is 381.

As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary. Use the Hawaii bonus tax calculator to determine how much tax will be withheld from your bonus payment using the aggregate method. The results are broken up into three sections.

The Hawaii Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Hawaii State Income. You can use our free Hawaii income tax calculator to get a good estimate of. Calculate your federal Hawaii income taxes Updated for 2022 tax year on Aug 31 2022.

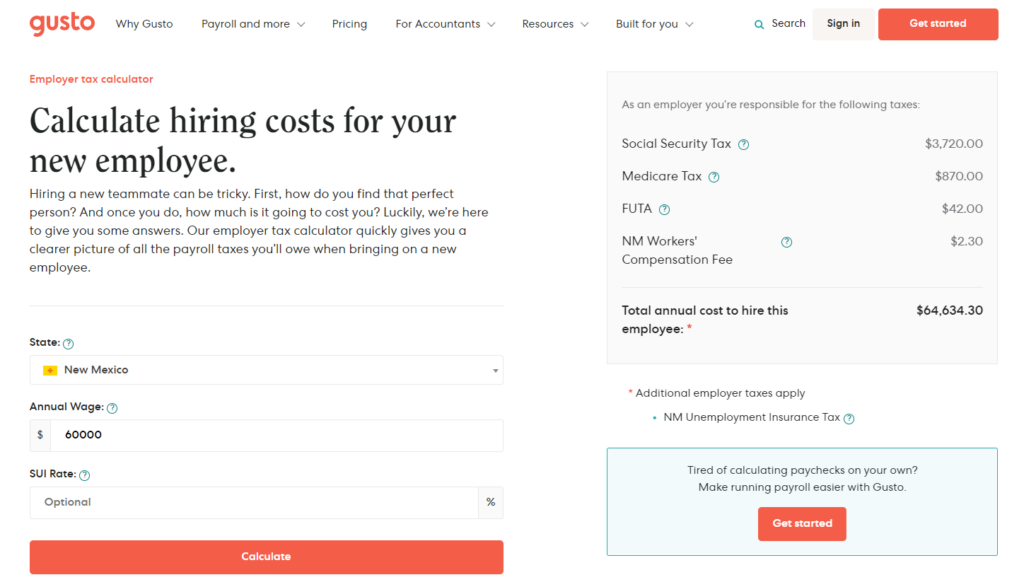

On the other hand if you make more than 200000 annually you will pay. Paycheck Results is your gross pay and specific. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Hawaii.

It is not a substitute for the advice of. Calculate your Hawaii net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Hawaii paycheck. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is.

Hawaii State Unemployment Insurance SUI As an employer in Hawaii you have to pay unemployment insurance to the state. First of all your income is taxed at 44 which means your Hawaii state. 2022 tax rates for federal state and local.

Your employees estimated paycheck will be 70372. Use this Hawaii gross pay calculator to gross up wages based on net pay. The 2022 tax rates range from 02 to 58 on.

Below are your Hawaii salary paycheck results. Hawaii Hourly Paycheck Calculator Results. This marginal tax rate means that your.

Lets go through your gross salary in further depth. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross. Just enter the wages tax withholdings and.

Well do the math for youall you need to do is enter the. Below are your Hawaii salary paycheck results. Hawaii Paycheck Calculator Use ADPs Hawaii Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Hawaii Hawaii Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and. Income Tax Calculator 2021 Hawaii Hawaii Income Tax Calculator 2021 If you make 70000 a year living in the region of Hawaii USA you will be taxed 14386. These calculators should not be relied upon for.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Hawaii residents only.

Hawaii Paycheck Calculator Adp

Financial Calculators American Savings Bank Hawaii

Salary Calculator Employee Salary Calculator Tool

Standard Deduction Tax Exemption And Deduction Taxact Blog

Financial Calculators American Savings Bank Hawaii

Do International Students Pay Taxes A Us Tax Filing Guide Shorelight Shorelight

How Are Workers Compensation Benefits Calculated Foa Law

2022 Gross Hourly To Net Take Home Pay Calculator By State

Tip Tax Calculator Primepay

4 Steps To Be More Financially Conscious This Year Hawaii Home Remodeling Debt Collection Managing Your Money Consumer Debt

Hawaii Paycheck Calculator Adp

How To Calculate Payroll Taxes In 5 Steps

How Unemployment Benefits Are Calculated By State Bench Accounting

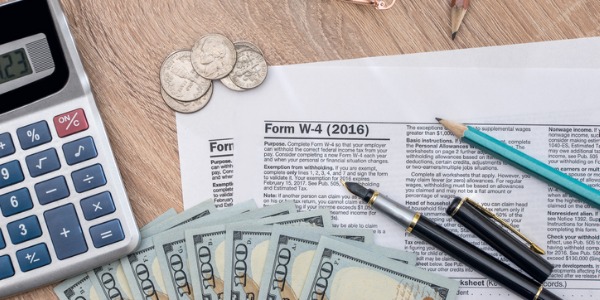

Paycheck Tax Withholding Calculator For W 4 Tax Planning

How To Calculate Payroll Taxes In 5 Steps

Financial Calculators American Savings Bank Hawaii

Free Online Paycheck Calculator Calculate Take Home Pay 2022